Diversifying your investment portfolio with precious metals is a practical way to boost your savings and prepare for retirement. IRA-eligible gold items, silver bullion, and platinum bars are just a few of the most popular options on the market. Still, choosing the best precious metal to invest in for your budget and storage limitations can seem overwhelming, especially if you’re new to precious metals investing.

At Learn About Gold, our experts guide you through the investment process using language you can understand. We discuss how to invest in precious metals and which options are worth considering.

Start supplementing your retirement savings with precious metals investments today by connecting with a reputable gold IRA partner.

Types of Precious Metals

Precious metals are high-value commodities like gold, silver, and platinum. For thousands of years, countless civilizations mined and refined these products to use as currency and to manufacture jewelry and technology.

Precious metal investments come in many shapes and sizes. Unlike stocks or paper money, these commodities require investors to plan for storage and transportation. Here is a list of different types of precious metal products and what to expect when investing.

Bullion Bars

Government-authorized mints refine precious metal ores into high-grade bullion bars. They value these products by weight and purity.

Bullion bars are backed by paper currency and are available for purchase through online brokers and collectors. Central banks typically trade 400-troy-ounce (12.4-kilogram) bars to authorized dealers, making them the most common option on the market.

You can identify the origin of your gold bars by checking the stamp on the surface. Additionally, each gold, silver, and platinum bar has a serial number to prevent counterfeit and theft.

Bullion Coins

Investors buy and sell precious metal coins, like bullion bars — through online brokers and central banks. However, individual gold and silver coins weigh significantly less than standard bars, making them more accessible to investors who want a more affordable way to add precious metal assets to their portfolios.

You should use caution when buying and selling precious metal coins. The IRS does not allow you to invest gold coins that are less than 99.5% pure in a precious metal retirement account. Always take the time to research which coins meet the minimum investment criteria before you commit to a purchase if you plan to open a silver or gold IRA.

Still, you can enjoy many benefits when investing in coins. For example, you can find IRA-eligible gold coins in pawn shops, through TV ads, and at online dealers — reinforcing gold’s reputation as the best precious metal to invest in for beginners. Additionally, gold coins may require less storage space than bulky bullion bars, allowing you to save money while you grow your investment.

Rounds and Collector’s Items

Dozens of private mints print gold, silver, and platinum coins for trade — also called “rounds.” Rounds differ from bullion coins in several ways. For example, governments do not recognize them as legal tender.

Rounds also have no face value. Some traders buy up rounds to complete a personal collection, but these commodities can be challenging to resell on conventional markets.

The risk of purchasing a counterfeit gold round can be relatively high. Some rounds do not have any identifying markers to confirm purity or origin. Hence, most investment experts do not consider gold rounds the best precious metal to invest in for your portfolio.

Rare Coins

Rare coins are stable investments for several reasons. First, they tend to yield high gold and silver purity. Rarity, in and of itself, can boost the value of a coin. This perk is practical for investors who want to hedge their portfolios against price dips in gold or silver metal.

Many governments have the authority to confiscate gold during economic or socio-political disasters. However, rare coins do not fall within any United States law or provision that allows confiscation.

Market Characteristics

The economic and long-term value of trading precious metals makes them a popular choice for investors who want to maintain a stable investment portfolio even during economic downturns. Here is what you can expect when buying and selling physical commodities like gold, silver, and platinum:

- Portfolio Diversification: Trading precious metals is an excellent way to diversify your portfolio with physical assets. It may be wise to invest in different types of precious metals (small and large quantities) to best hedge against inflation. When you have precious metals in addition to stocks and bonds, your portfolio is more resilient against stock market downturns.

- Predictable Pricing: The market price of high-value precious metals generally resists significant fluctuations during short-term recessions, global conflicts, and stock-market crises. In fact, researchers at the International Management Institute observed a steady increase in the price of gold between January 2019 and February 2021 — the height of the COVID-19 pandemic.

- Tax Reporting: The federal government issues tax reporting requirements for bullion bars and coins. These regulations change from time to time, so it’s important to stay updated while trading.

- Interest Rates: Many precious metals, like gold and copper, are integral to the production of modern electronics. As of 2023, the interest rates on some of these commodities are on the rise due to industrial demand.

You cannot purchase precious metals directly from the U.S. Mint without authorization. Here are a few of the locations where you can buy gold and other precious metals:

- Online gold and silver retailers

- Local coin shops

- Collector’s marketplaces

- Auction houses

- Derivative markets

Investment Considerations

You must consider a few essential investment tips before you can choose the best precious metal to invest in for your savings.

Budget

Investing in precious metals is a financial commitment. Gold and platinum cost the most on the conventional market, so many investors choose to start small if they don’t have a large budget for physical commodities.

Silver and copper are historically safe investments for those who want to diversify their portfolios with affordable coins. You may be able to use the capital gains on these assets to fund more expensive precious metals down the line.

Timing

Buying and selling precious metals at the right time is the key to getting the most from your investments. Consider hiring a financial advisor or precious metal custodian to monitor changes in the market so you know when to buy when prices are low and sell when prices are high.

Storage and Transportation

You need a place to store your precious metals after their purchase. Reputable dealers will provide safe shipping and transportation for both small and large quantities of metal. They may partner with an authorized depository or give you the option of choosing one yourself.

Use caution if you plan to store your coins at home. Always keep them in a secure, fire-proof container or out-of-sight vault. Damage and theft could contribute to irreparable losses for your investment.

Gold as an Investment

Most investors agree that gold is the best precious metal to invest in, whether you want to fund a precious metals IRA or sell the gold locally.

Gold backs many global currencies and is tradable in nearly every country. Additionally, it will not rust easily. You can buy gold in the form of bullion coins and bars, and you can also invest in gold exchange-traded funds (ETFs).

Gold offers impressive returns and long-term stability. Still, it may take years before you enjoy a substantial profit from your investment.

Silver as an Investment

Silver is an excellent investment alternative to gold. While it is less expensive, it can yield substantial returns over time. Many investors choose silver for its accessibility and industrial applications — silver is necessary for producing electronics, so its value remains high.

Silver prices are more volatile than gold, so it may be better to use this precious metal as an auxiliary investment to more stable options. Consider starting your investments with silver coins and working your way up to bars.

Platinum as an Investment

Platinum is an essential metal in the oil, electronic, and car industries. Like gold and silver, platinum retains its value during economic downturns. Even small investments can yield sizable returns in the future. However, platinum prices fluctuate more than both gold and silver prices, so use caution when trading large quantities.

Bullion platinum bars are the most common platinum investment. However, platinum jewelry and rare coins are also popular among online retailers.

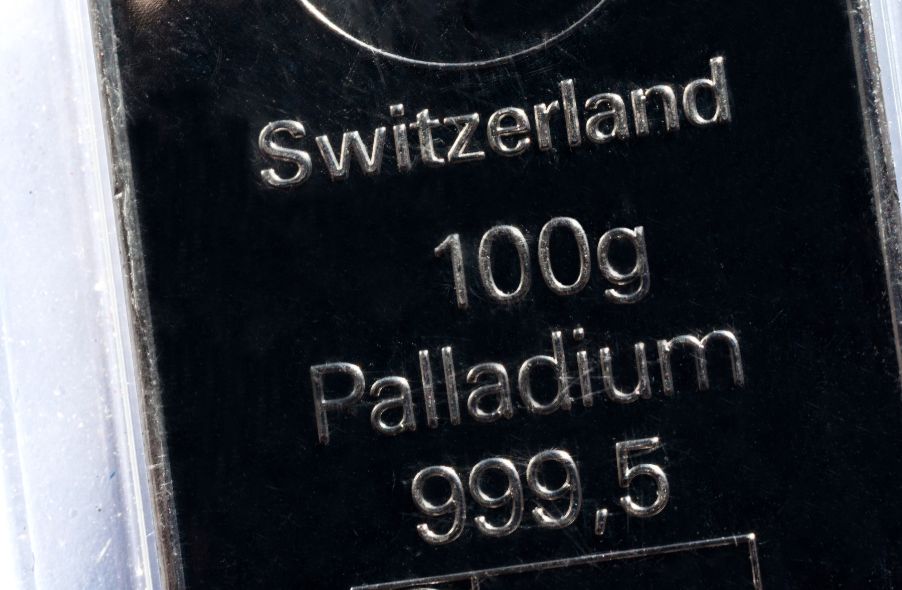

Palladium as an Investment

New investors often overlook the value of palladium during their initial purchases. Palladium is a robust metal used in catalytic converters, factories, and hydroelectric treatment facilities. The majority of the world’s palladium comes from the United States, Russia, and South Africa.

Palladium is the best precious metal to invest in if you want a low-volatility asset with promising return potential. Most investors consider palladium to be a sister metal to platinum. Trading them simultaneously can diversify your portfolio quickly.

Despite its many advantages, striking mine workers and increased demand during the early 2020s forced many of these markets into decline. Keep an eye on the price of palladium as your investment budget grows.

Copper as an Investment

Copper is popular for its low price compared to other precious metals. Copper’s value stays relatively high because it’s necessary in the construction, automotive, and electrical industries, especially to insulate cables and manufacture computer chips.

Copper is a relatively low-risk investment asset. However, new copper mines opening around the world may create disruptions in the market that result in dramatic price fluctuations.

Rhodium as an Investment

Rhodium may not spring to mind when you think about the best precious metals to invest in, but it is still worth a place on this list. Rhodium is essential to the modern car manufacturing industry and other production sectors of the economy. This metal has a high melting point, making it difficult to shape and counterfeit outside of licensed facilities.

Unfortunately, it can be difficult to shop for rhodium outside of niche marketplaces. Partner with a trusted broker to discover which options are available near you.

Investment Methods

You can invest in precious metals in several ways. A precious metal IRA is a popular option among those who want to grow their returns for retirement.

You can also trade these commodities through gold-backed certificates, ETFs, or stocks. These methods eliminate the need for storing physical gold. Still, owning physical gold provides additional security and stability for your savings during economic disasters.

Partnering with a gold IRA expert is the best way to ensure that you make the right financial decisions for your investments. At Learn About Gold, we can answer your questions and match you with a reputable gold IRA company. You can also learn more about gold, silver, and platinum investments by exploring our blogs.

Contact Learn About Gold for more information about the best precious metal to invest in on a budget. Contact us to send us your questions or concerns.