Investors are always looking for the next big thing, and platinum has been getting more attention recently because of its limited supply and high demand, leading to big returns for investors. Gold and silver have been common targets for precious metal investments for a long time, but platinum’s popularity is relatively recent despite its widespread use for manufacturing and jewelry.

Is platinum more valuable than gold? Is it a good investment? Read on as we aim to answer these questions and more about this rare, silver-white metal.

For more information on investing in a gold IRA, visit our Learn About Gold website.

Platinum vs. Gold in Jewelry

Gold has been the go-to precious metal for jewelry for thousands of years because of its high value and radiant yellowish appearance. Platinum is a light silver or white color that’s also a popular choice for rings, necklaces, earrings, and bracelets. Choosing between these precious metals for your jewelry is mostly subjective, depending on a person’s aesthetic tastes.

The differences between platinum and gold jewelry include:

- Density. Platinum is denser than gold, meaning that it’s less likely to break into pieces.

- Softness. Gold is a soft metal, but platinum is even more delicate. Since it’s more prone to scratches on its surface, you might spend more time polishing your platinum jewelry.

- Hypoallergenic quality. While gold isn’t a common allergy, gold rings and other jewelry often contain metals (such as nickel) that are. Platinum is a very pure metal, which means that a platinum ring or necklace could be better for people who want to avoid allergic reactions.

- Wear and tear. Gold jewelry, particularly white and rose gold, can lose its shine over time. However, platinum is low maintenance, and you can easily polish it at home.

Platinum vs. Gold in Manufacturing

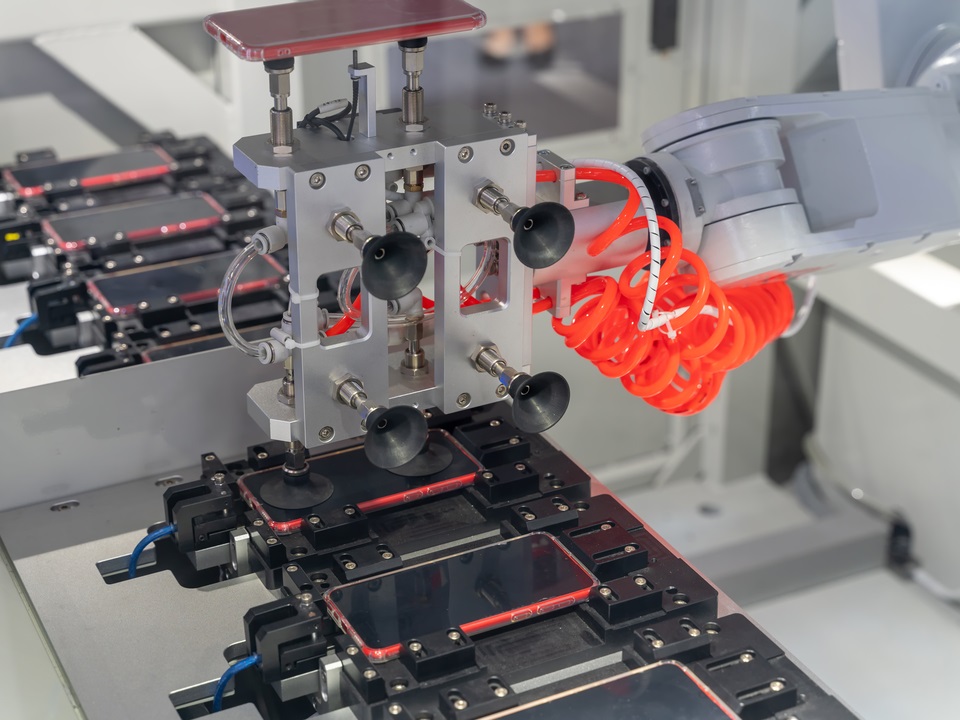

Gold is in high demand for economically stable industries like jewelry, electrical, and medical equipment, while platinum’s demand today mainly comes from the auto industry. Manufacturers use the durable metal to make catalytic converters for cars, causing the demand for platinum to rise and fall with the need for automobiles.

The auto industry accounts for half of platinum’s total demand because the metal works so well for converting harmful emissions from cars into less impactful waste—which is the purpose of catalytic converters. Aside from vehicles, platinum also has uses for producing nitric acid, silicone, computer hard disks, spark plugs, LCDs, and dental fillings.

Gold has almost endless uses across many industries. It’s the most popular metal for jewelry, but it’s also common for art, architecture, and electronics. Gold is a conductor of electricity and resistant to corrosion, making it an effective shield for electrical components such as copper. Tiny gold wires make up the circuits in computer chips.

Only a few countries mine platinum, notably South Africa, Russia, and Zimbabwe. The lack of sources for this rare metal means that the geopolitical climate greatly affects its price. For example, when demand skyrocketed in late 2020 following the pandemic-induced dip, a prominent South African factory shut down. AS a result, the platinum supply went down while the price rose steadily until early 2021.

Platinum is rarer than gold because it’s harder to mine, not because there’s less of it on the planet. You can find gold mines all over the world, and the metal is easy to find since it’s close to the surface. Platinum, on the other hand, is deep beneath the Earth’s crust, making it much harder to locate.

Platinum vs. Gold in Precious Metal Investment

Gold and platinum have many uses, from jewelry to electronics manufacturing—but which is the better investment?

Platinum’s price is highly volatile because its supply and demand are susceptible to change based on what’s happening in world politics and the economy. Steep peaks and valleys could be an opportunity for significant gains but also substantial losses.

The price of gold is not so easily upset, so its stability makes it a solid investment if you’re looking for an alternative to traditional stocks. Platinum is often at a higher price than gold, but this ratio can and does change quickly. As of 2022, the world has a relatively high supply of platinum, but the demand is low. For this reason, platinum prices have dropped significantly below those of gold.

Due to platinum’s unpredictability, seasoned investors don’t typically recommend buying platinum if you’re new to investing. Gold or silver is a much safer choice if you’re just starting out, but platinum could be useful if you want to diversify your portfolio with more precious metals.

Why Is Platinum More Valuable Than Gold?

Platinum is much rarer than gold and other metals that investors buy, including copper and silver. South Africa produces more platinum than any other country, so disruptions to operations in that country can severely affect the worldwide supply of platinum. While platinum’s price relies heavily on supply and demand, gold is much more stable.

Will Platinum Overtake Gold?

Precious metals are a common analogy for rankings, such as music records or awards, and platinum is always above gold in these scenarios. Platinum’s rarity makes it seem more valuable—but can it overtake gold as an investment?

During especially stable economic periods, platinum can potentially exceed the price of gold by a significant amount. However, the cost of platinum often falls below gold whenever a disruption to the worldwide economy occurs. To predict when the price of platinum will exceed gold, you would have to know when there will be supply issues with major producers like South Africa.

As of May 2022, platinum production is down, according to the World Platinum Investment Council (WPIC). WPIC predicts that it will continue declining because of the geopolitical situation, particularly in Russia (one of the top platinum-producing countries) as it continues its invasion of Ukraine. In Q1 of 2022, platinum demand sank by 26%, and supply went down by 13%.

Is Platinum Worth Buying?

Is platinum more valuable than gold? Is it worth buying? As you might have noticed, the answer is not so simple.

If you are looking for alternatives to a traditional IRA and deciding whether to buy gold or platinum, gold is likely your safest bet. Gold is a secure and stable investment for a retirement account, while platinum fluctuates much more often. This doesn’t mean that platinum is always a bad investment, but you should consult with a financial adviser to determine if it’s the right call for you.

A financial professional can determine market trends by looking at the price differences between platinum and gold. They communicate the difference using a ratio; platinum is cheaper if the ratio is more than 1. If it’s less than 1, platinum is more expensive.

Many factors play into commodity investing, especially with a volatile asset like platinum. The investor should have a high level of expertise and tolerance for risks. If you’re a beginner looking to diversify your portfolio with precious metals, investing in a reliable metal like gold would be much safer.

Gold has been a common currency throughout history, and it still holds weight as a backup to cash because it will always have value even during an economic crisis. Platinum does have value outside of investments, but it would be harder to liquidate than gold.

If you want to learn more about gold IRAs and how you can start investing in gold, visit our Learn About Gold website and take The Gold Quiz to find the best investment provider for you.